Buying your home in cash is worth its weight in gold. Since we believe that another competitive real estate market is looming in 2024, we have cash opportunities outside of traditional financing to help you navigate the marketplace.

A full cash buyer is more likely to secure a contract they desire and often at a lower price point. Cash also gives buyers confidence to bridge financing while they deal with selling a pending transaction.

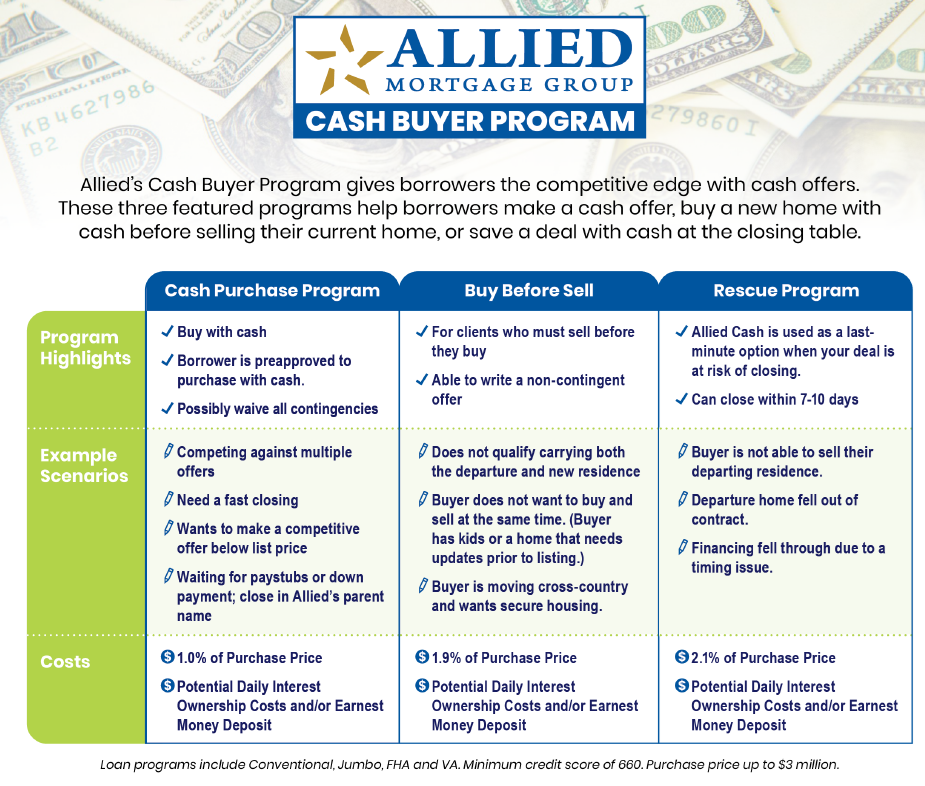

Allied offers a multitude of cash options for different buyers’ situations.

As a buyer, you need to be pre-approved for a conventional mortgage to use any of our cash products. You can have as low as a 660 middle FICO score to proceed. You must have the ability to put 5% down but may be able to put down less.

Using a Cash Offer to Secure the Contract —

After bring pre-underwritten, you move forward with a cash offer in the marketplace to go under contract. Then you have the option to use traditional financing during the contract. You can be charged the minimal fee to use this cash program, gain the competitive advantage, obtain favorable interest rates, and fund with a loan. This cash offer or addendum is as good as cash when presented to the seller, and Allied will purchase the home in cash if you are not going to use traditional financing along the way. You can utilize Freddie Mac, Fannie, VA, and Jumbo financing.

Buy a Home with Cash before Selling your Departure Residence —

Using cash to buy before selling also requires you to be fully underwritten. In this case, you are working to bridge a local purchase. You have a home to sell but would rather purchase first locally and then sell after the sale. The home for sale can be out of state, but typically it is a local home that will sell after the purchase with a cash offer represented by Allied. We all work with you to have a comprehensive plan for the sale of your departure residence to complete the full transaction.

With the combined factors of interest rates moving down this year, the Federal reserve shifting their monetary policy to lower rates, a backed-up demand of homebuyers, and eventual loosening of the inventory, I see more competition coming this year. Our Allied toolbox of loan products provides out-of-the-box solutions for you to buy your new home or move from your old home.

Contact any of us to help you look at your options @alliedrockymountains.